2025 Adjusted Gross Income Tax Brackets

2025 Adjusted Gross Income Tax Brackets. See current federal tax brackets and rates based on your income and filing status. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent and 37.

10%, 12%, 22%, 24%, 32%, 35%, and 37%. The highest earners fall into the 37% range, while those who earn the least are.

Federal Tax Brackets 2025 Single Mela Stormi, For tax years 2025 and 2025, there are seven different tax brackets: See states with no income tax and compare income tax by state.

When Are Taxes Due For California Residents 2025 Devin Feodora, The table below shows the tax brackets for the federal income tax, and it reflects the. These tax brackets were put in place by the tax cuts and jobs.

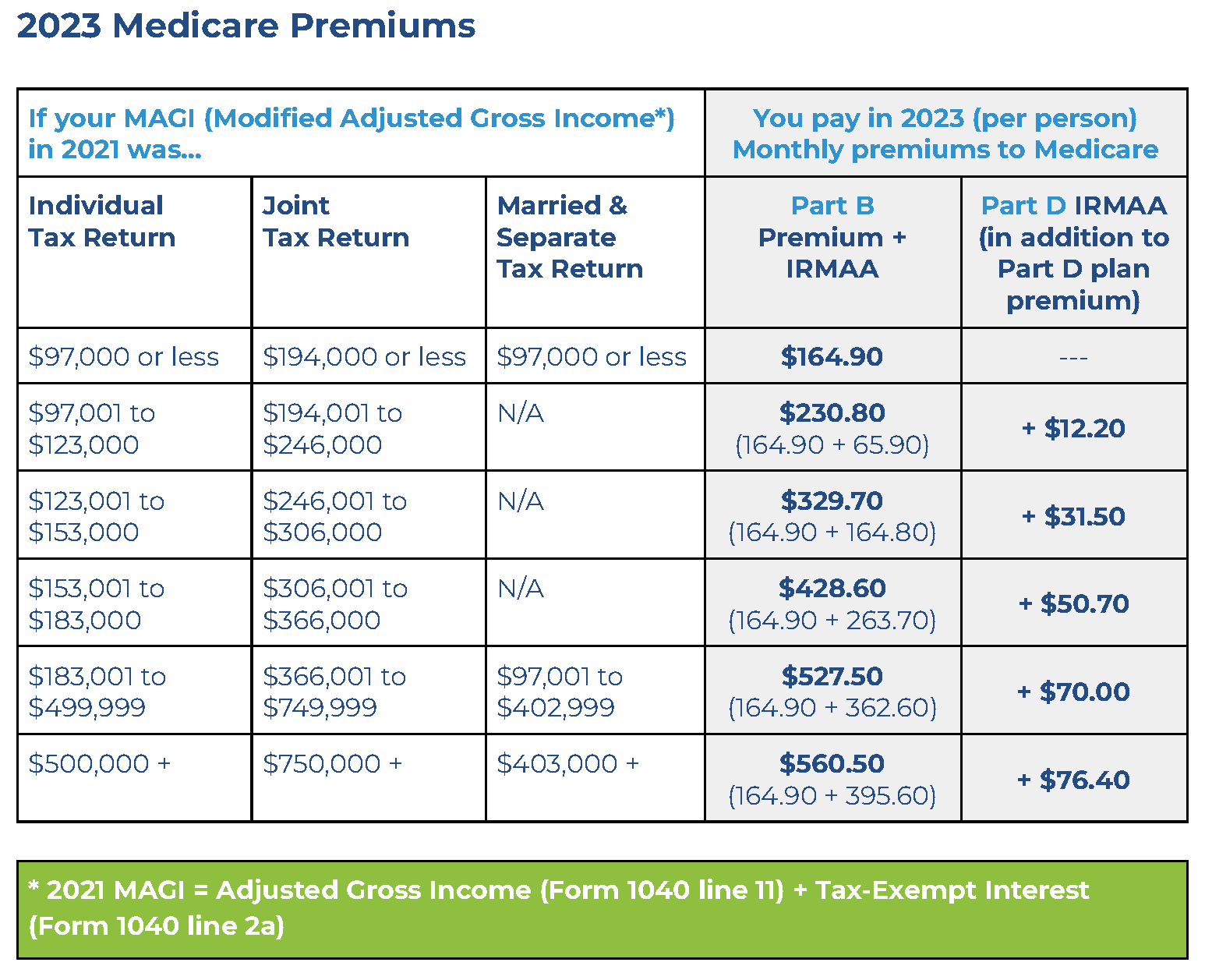

Irmaa 2025 Rates Brackets PELAJARAN, For 2025, the seven federal income tax rates are 10%, 12%, 22%, 24%, 32%, 35% and 37%. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent and 37.

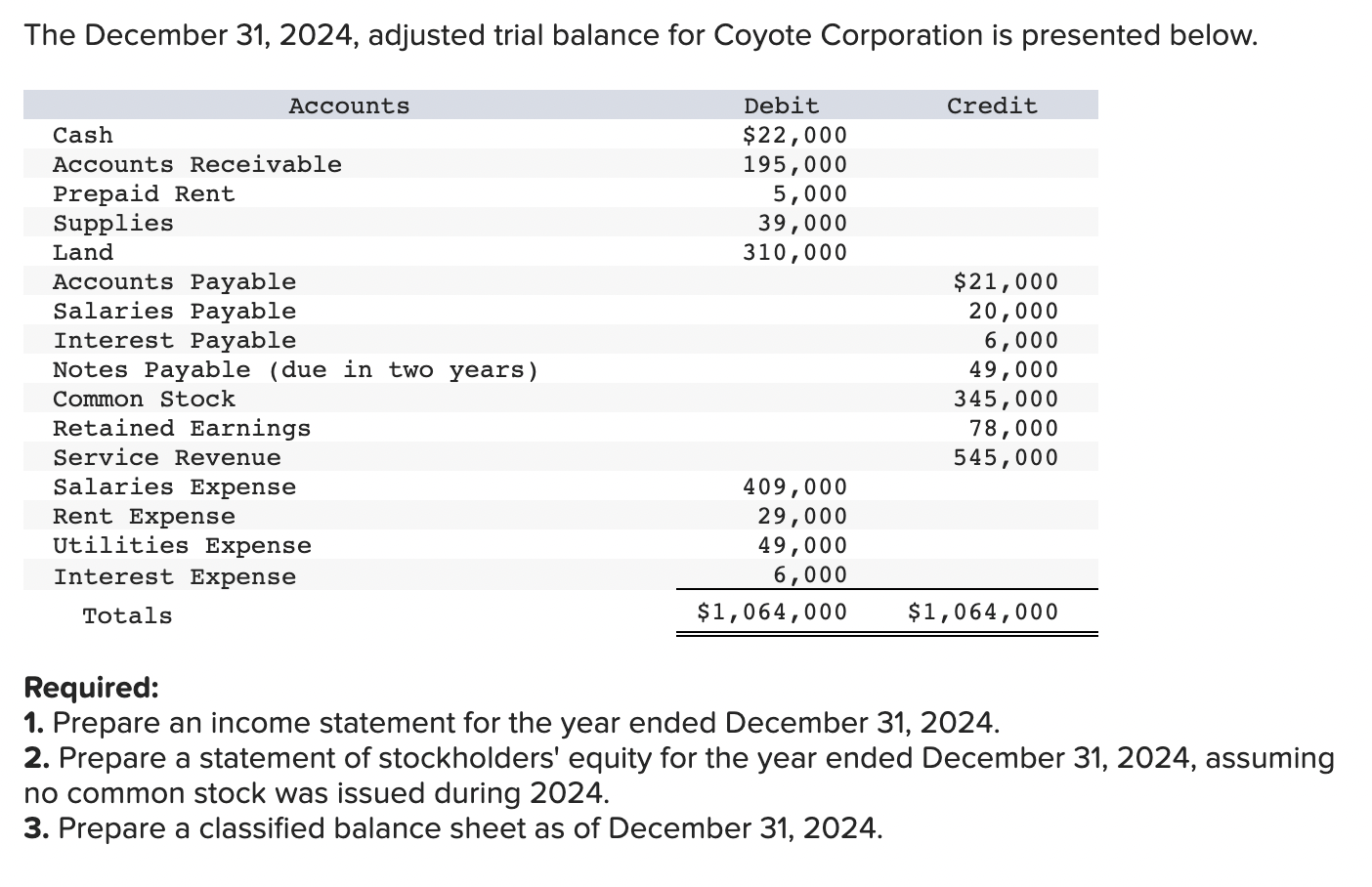

Solved The December 31, 2025, adjusted trial balance for, Explore the latest 2025 state income tax rates and brackets. These rates apply to your taxable income.

Understanding 2025 Tax Brackets What You Need To Know, For the 2025 tax year, the adjusted gross income (agi) amount for joint filers to determine the reduction in the lifetime learning credit is $160,000; The seven federal income tax brackets for 2025 and 2025 are 10%, 12%, 22%, 24%, 32%, 35% and 37%.

Why Filing Taxes Separately Could Be A Big Mistake (when on Medicare, 10%, 12%, 22%, 24%, 32%, 35%, and 37%. 10%, 12%, 22%, 24%, 32%, 35% and 37%.

.png)

Key Facts You Need to Know About Definitions for Marketplace and, There are seven federal tax brackets for tax year 2025. Your bracket depends on your taxable income and filing status.

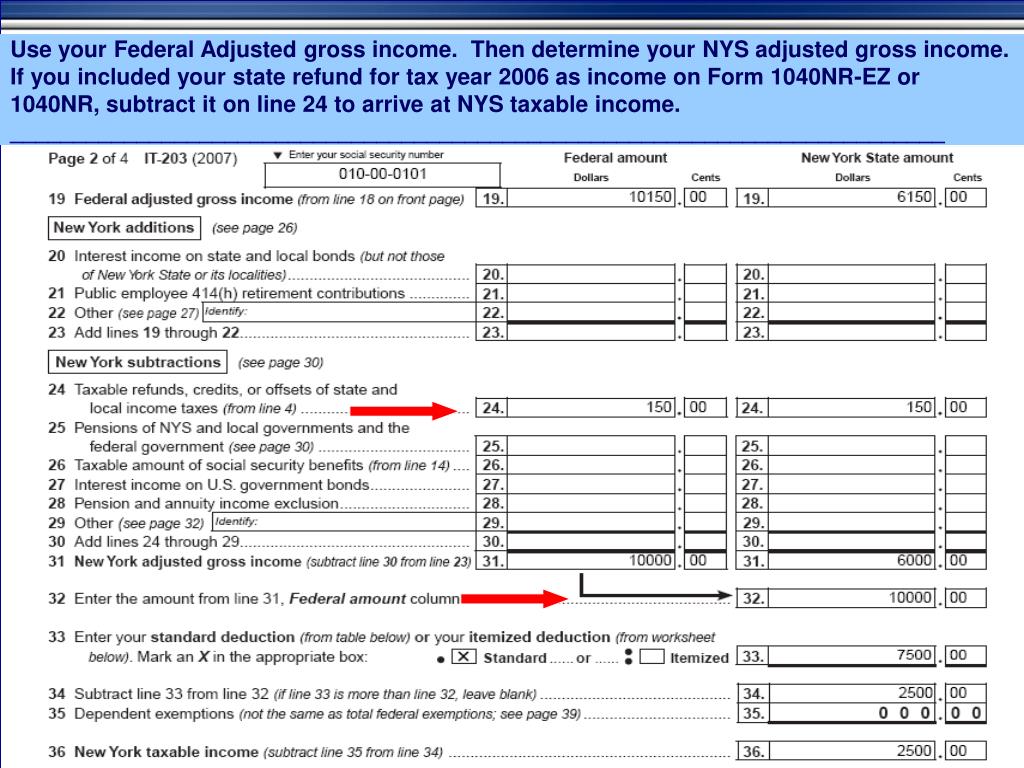

PPT New York State Department of Taxation and Finance PowerPoint, 10%, 12%, 22%, 24%, 32%, 35% and 37%. Income tax brackets — for taxable income in 2025 income thresholds for tax brackets will increase by approximately 5.4% for 2025.

What tax bracket am I in? Here's how to find out Business Insider Africa, The tax rates continue to increase as someone’s income moves into higher. See current federal tax brackets and rates based on your income and filing status.

Net vs. Adjusted Gross (AGI) What's the Difference? in, Taxable income is calculated by subtracting. Your taxable income is your income after various deductions, credits, and exemptions have been.