Fsa Maximum Contribution 2025

Fsa Maximum Contribution 2025. Here are the new 2025 limits compared to 2025: Dcfsa saw no change to limits, which are set by statue and not linked to inflation.

The fsa contribution limit is going up. The irs has recently disclosed adjustments to contribution limits for 2025, bringing some changes to both fsas and hsas.

An employee who chooses to participate in an fsa can contribute up to $3,200 through payroll deductions during the 2025 plan year.

Maximum Fsa Contribution 2025 W2023E, The fsa contribution maximum for the 2025 plan year is $3,200. Ogb will be extending annual enrollment for employees who entered the 2025 maximum amount of $3,050.

Fsa 2025 Contribution Limits 2025 Calendar, November 10, 2023federal legislative update print this article. Beginning in 2025, employees who participate in an fsa can contribute a maximum of $3,200 through payroll deductions, marking a $150 increase from this.

fsa health care limit 2025 Kittie Gale, Irs announces fsa contribution cap for 2025. Beginning in 2025, employees who participate in an fsa can contribute a maximum of $3,200 through payroll deductions, marking a $150 increase from this.

FSA contribution How do I contribute? All About Vision, The internal revenue service (irs) has announced. In 2025, employees can contribute up to $3,200 to a health fsa.

2025 FSA Contribution Limit Increases Wallace, Plese + Dreher, Keep reading for the updated limits in each category. This is unchanged from 2025.

What’s the Maximum 401k Contribution Limit in 2025? MintLife Blog, Ogb will be extending annual enrollment for employees who entered the 2025 maximum amount of $3,050. Irs announces fsa contribution cap for 2025.

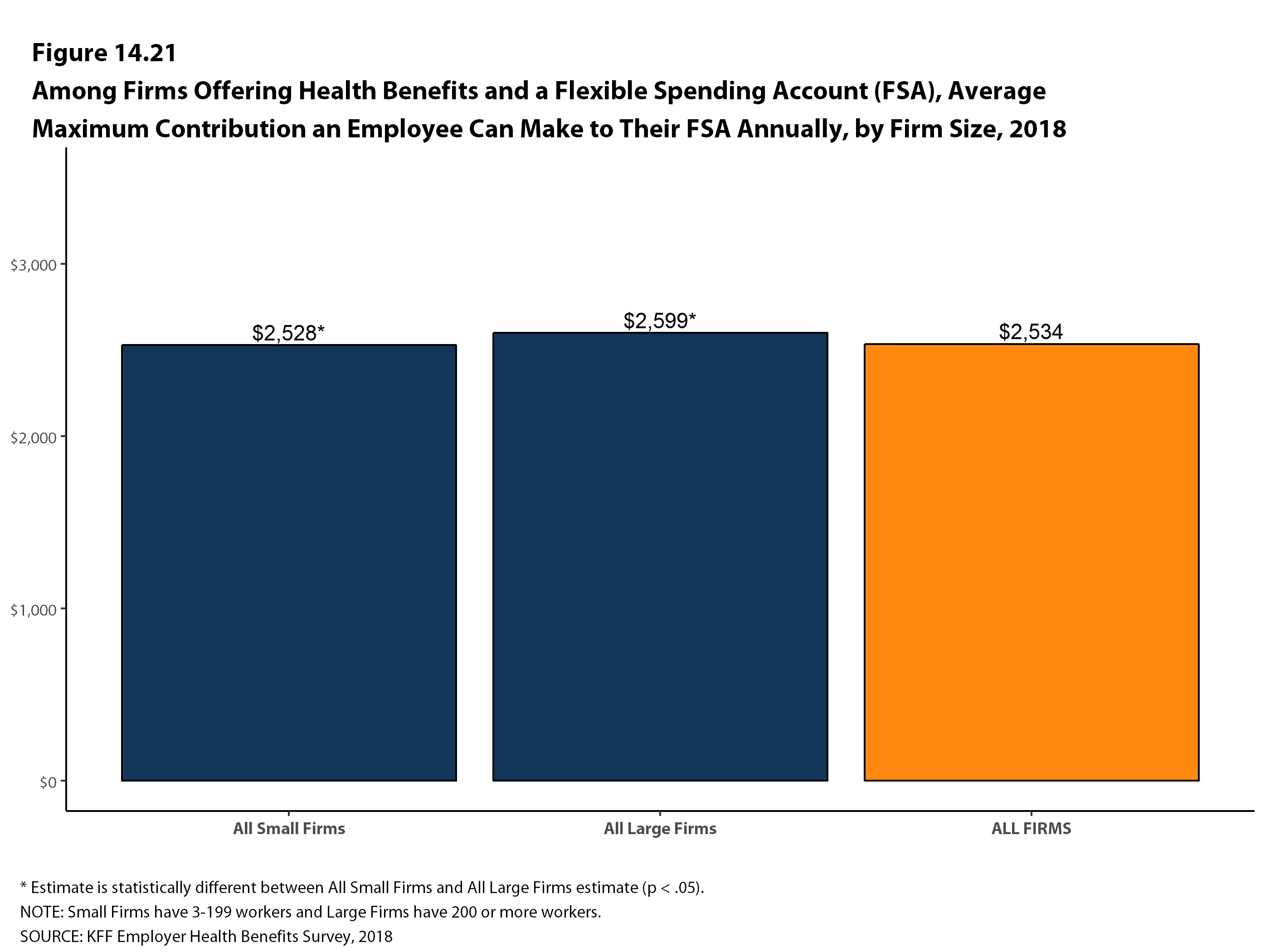

Among Firms Offering Health Benefits and a Flexible Spending Account, For 2025, there is a $150 increase to the contribution limit for these accounts. An employee who chooses to participate in an fsa can contribute up to $3,200 through payroll deductions during the 2025 plan year.

IRS Announces 2025 Limits for Health FSA Contributions and Carryovers, Ogb will be extending annual enrollment for employees who entered the 2025 maximum amount of $3,050. An employee who chooses to participate in an fsa can contribute up to $3,200 through payroll deductions during the 2025 plan year.

2025 FSA & Retirement Plan Contribution Limits (3) San Rafael Employees, Ogb will be extending annual enrollment for employees who entered the 2025 maximum amount of $3,050. If you don’t use all your fsa funds by the end of the plan.

Maximum Fsa Contribution 2025 W2023E, Irs announces fsa contribution cap for 2025. Keep reading for the updated limits in each category.

For 2025, the fsa annual salary reduction limits are set at $3,200, up almost 5% from $3,050 in 2025.

Beginning in 2025, employees who participate in an fsa can contribute a maximum of $3,200 through payroll deductions, marking a $150 increase from this.